owner draw vs retained earnings

There are two main ways to pay yourself. Owners Draws 50000 Total Closing Owners Equity.

Retained Earnings What Are They And How Do You Calculate Them

If you are generating profits which I assume you are in order to continue taking draws then your retained earnings would be positive.

. This is the final step which will also be used as your beginning balance when calculating next years retained earnings. Retained earnings can also be accumulated losses of the business if the business has. Beginning Balance of Retained Earning is the previous years statement of retained earnings.

Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering. The draw decreases the owners capital record and owners equity so now the equation will be. You cannot set up Subaccounts here.

Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders. It creates a negative drawings impact on the business. Whatever the debit balance is in the dividends account a credit entry is made for that amount to bring its balance to zero then a debit entry is made for the same amount in retained earnings.

If you net the accounts together you should get partner capital. So if I understand correctly your contributiondrawing is negative. However that isnt without its risks.

As for Owner Equity open the chart of accounts and try to open each Equity account. A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners. Owners Drawings are any withdrawals by the owners from the business either in the form of goods services or cash for their personal use.

How do you close out owners draw to Retained Earnings. Answer 1 of 8. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

Closing Drawing Account This is accomplished by making a credit entry in the drawing account for whatever the debit balance is and making a debit entry for that amount in the owners capital account. The owner still must keep track of his expenses revenues and net income as well as the money he keeps in the business and uses for equipment transportation postage salaries and other expenses. Do draws affect retained earnings.

A Comparison viewed April 6 2022https. In other words retained earnings are accumulated earnings of a business after paying dividends or drawings to its stockholders or owners. The business would record such overcompensations as directors or owners loans.

In fact an owner can take a draw of all contributions and earnings from prior years. The one that does NOT have a Register view no matter what it is named is Retained Earnings or Owner Equity that QB sill close the prior year into. The draw method and the salary method.

The accounts you are referring to are cumulative in Wave. The WHY you took funds draw. Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings.

It can decrease if the owner takes money out of the business by taking a draw for example. Normally this happens in a single person company and in a limited manner in a partnership. The capital account is similar to the retained earnings account in a corporation.

Owners Equity 400 Assets 1200 Liabilities 800. With the draw method you can draw money from your business earning earnings as you see fit. The owners loan will be adjusted against dividends or distributions when available.

Retained earnings is where profits and losses get closed to at the end of the year. Salary method vs. The process for closing the drawing account for a corporation is similar to that for a partnership.

If the owners draw is too large the business may not have sufficient capital to operate going forward. Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how. Supedium November 16 2020 Owners Equity vs Retained Earnings.

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

How To Calculate Retained Earnings Formula Example And More

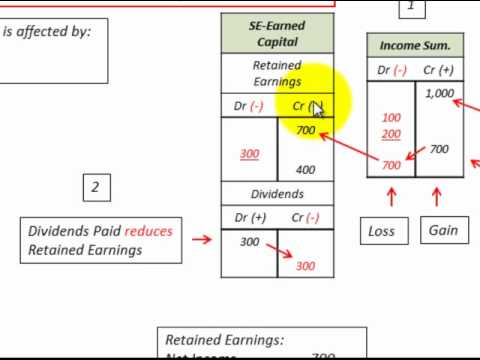

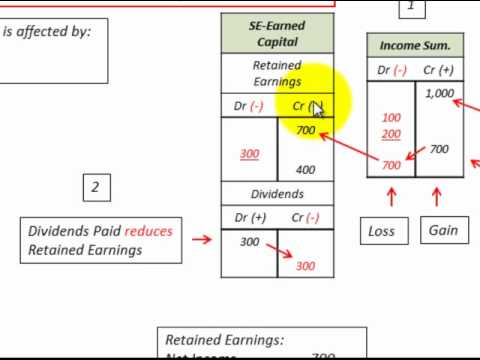

Retained Earnings Accounting Affected By Net Income Dividends Paid B S I S Accounts Youtube

Retained Earnings What Are They And How Do You Calculate Them

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Business Questions Financial Statement

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Retained Earnings Formula And Excel Calculator

New Wave Difference Between Business Owner Contribution Drawing Vs Retained Earnings Wave Community

Negative Retained Earnings Accounting Services

Retained Earnings Formula And Excel Calculator

Retained Earnings What Are They And How Do You Calculate Them

Retained Earnings Formula And Excel Calculator

Owners Equity Net Worth And Balance Sheet Book Value Explained

Accounting Equation Retained Earnings Net Income Dividends Video Youtube

Acca F7 Consolidated Sofp 3 Post Acquisition Retained Earnings Youtube

Retained Earnings Account Is Missing

Example Statement Of Retained Earnings Earnings Net Income Income

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template